work opportunity tax credit questionnaire form

EWOTC increases efficiency in processing new applications and decreases the. Below you will find the steps to complete the WOTC both ways.

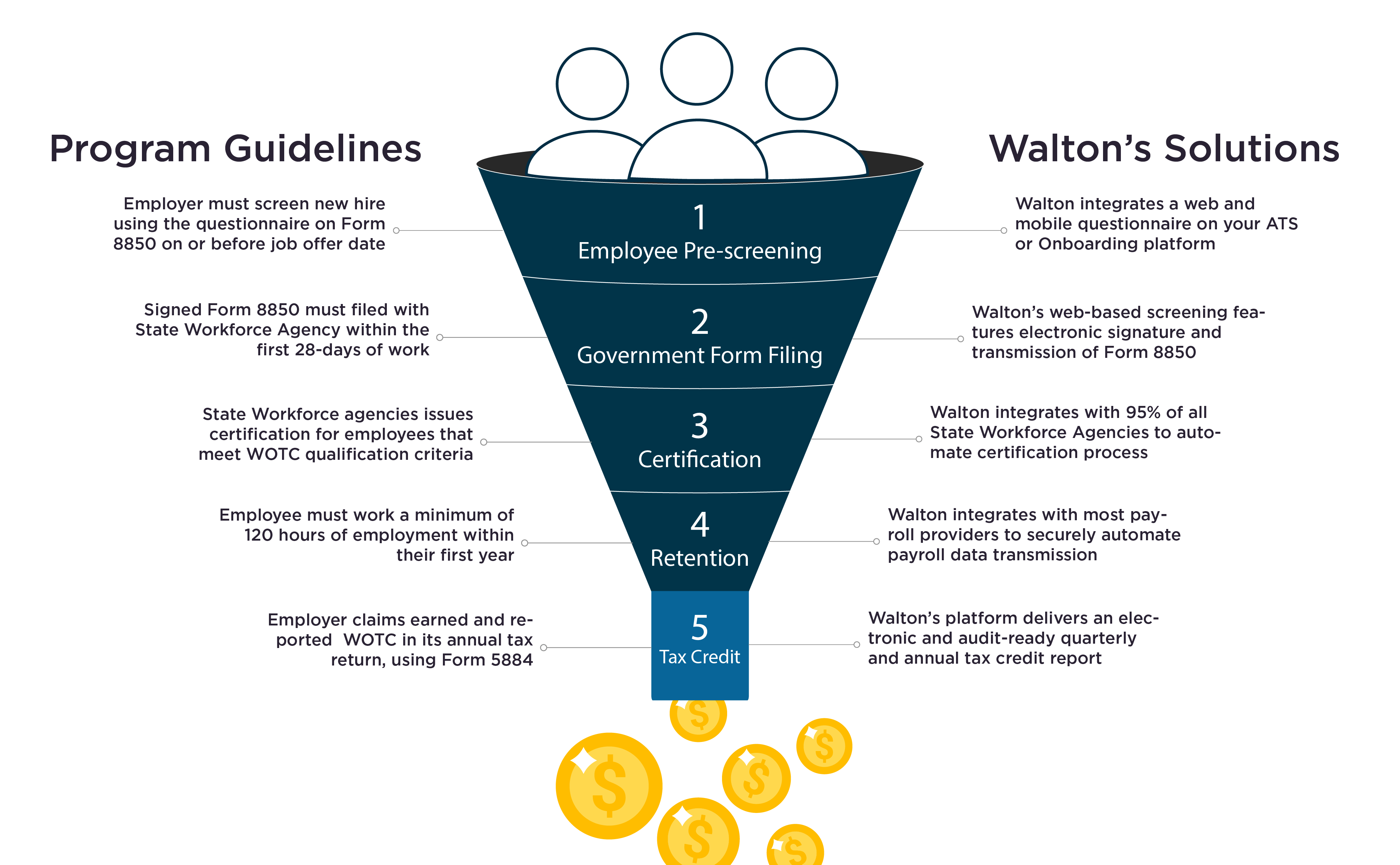

Employers must apply for and receive a certification verifying the new hire is a.

. Complete ETA Form 9061 after the individual is hired. Work Opportunity Tax Credit questionnaire Page one of Form 8850 is the WOTC questionnaire. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions.

The Work Opportunity Tax Credit WOTC program is a federal tax credit available to employers if they hire individuals from specific targeted groups. The form may be completed on behalf of the applicant by. Complete page 1 of IRS Form 8850 by the day the job offer is made.

About Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit Employers use Form 8850 to pre-screen and to make a written request to their state workforce agency SWA to certify an individual as a member of a targeted group for purposes of qualifying for the work opportunity credit. WOTC Work Opportunity Tax Credit Questionnaire KS Staffing Solutions Inc. Apply for Work Opportunity Tax Credits You can use the online service eWOTC to submit WOTC Request for Certification applications and to view and manage submitted applications.

Below you will find the steps to complete the WOTC both ways. Maximize your tax credit eligibility. Complete page 2 of IRS Form 8850 after the individual is hired.

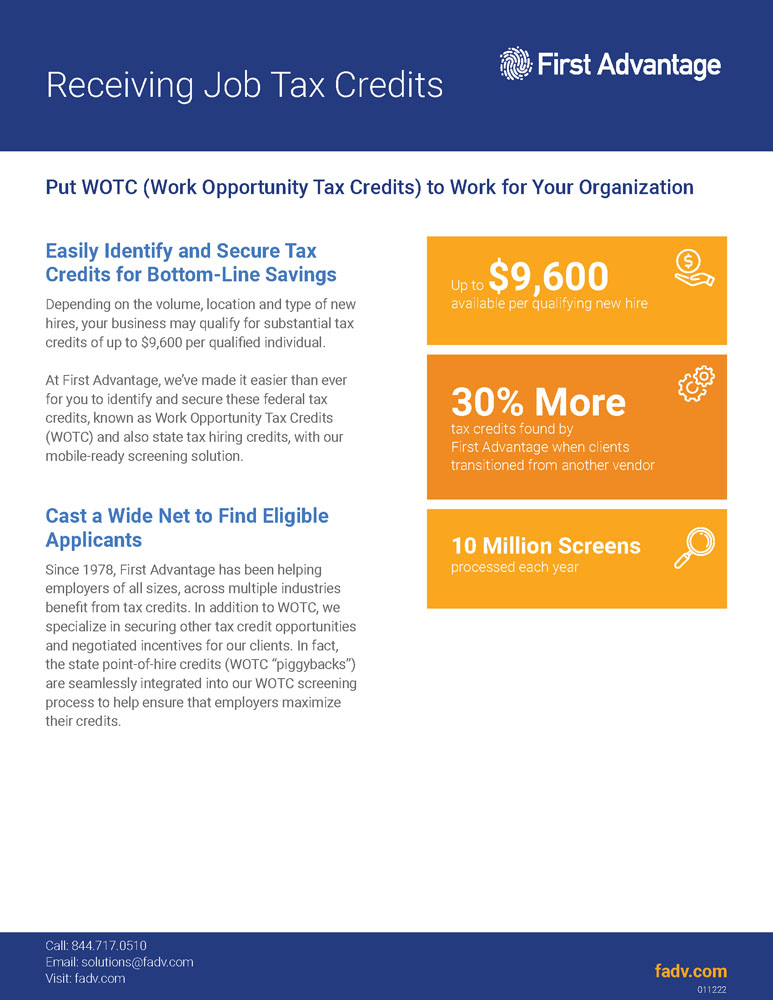

ADPs benchmarking analytics and intelligent forecasting tools help maximize results and avoid financial surprises. How to Apply for the WOTC Tax Credit. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment.

Push Alerts Text and email. Complete BOTH SIDES of the IRS Form 8850 Work Opportunity Credit Pre-Screening Notice and Certification Request. Hi the Work Opportunity Tax Credit Questionnaire is a questionnaire that employers give to their new hires to determine if they are eligible for a tax credit for hiring that person.

AlwaysOn Reporting Our advanced platform delivers an array of real-time reporting that encompasses all critical metrics of your WOTC program beginning with monitoring all your hiring activity and ensuring all new hires get screened for WOTC so you can maximize your tax credits. The employee groups are those that have had significant barriers to employment. To create an E-WOTC account click here.

Completing Your WOTC Questionnaire Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. The program has been designed to promote the hiring of individuals who qualify as a member of a target group and to provide a Federal Tax Credit to employers who hire these individuals. WOTC powered by technology that always keeps you in-the-know.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Our single-page questionnaire and intuitive web and mobile app increase application rates and simplify the capture of required WOTC data. The job applicant should complete the front side and the employer or representative must complete the.

WOTC forms are available in English Spanish and Russian versions. IRS form 8850 must be submitted within 28 days of the employees start date. The main objective of this program is to enable the targeted employees to gradually move from economic dependency into self-sufficiency as they earn a steady.

Optimize results with financial insights. Work Opportunity Tax Credit questionnaire. Completing Your WOTC Questionnaire Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef.

This tax credit program has been extended until December 31 2025. Employers may meet their business needs and claim a tax credit if they hire an individual who is in a WOTC targeted group. Complete only this side.

At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our website. Your name Social security number a. The Leading Online Publisher of National and State-specific Legal Documents.

Submit the completed and signed IRS and ETA forms to the appropriate state workforce agency within 28 calendar days of the new employees start date. To claim the tax credit when filing your federal business tax return use IRS form 5884. Help state workforce agencies SWAs determine eligibility for the Work Opportunity Tax Credit WOTC Program.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. January 2012 Department of the Treasury Internal Revenue Service Pre-Screening Notice and Certification Request for the Work Opportunity Credit a See separate instructions. Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Each new hire completes an IRS 8850 form online or paper version. 501c tax exempt organizations use IRS form 5884-C. 1 the employer or employer representative the SWA a participating agency or 2 the applicant directly if a minor the parent or guardian must signtheform andsignedBox 25aby theindividual completingthe.

In the case of the above question the sender did not provide their email address so we were unable to reply directly to them. Page one of Form 8850 is the WOTC questionnaire. What is the Work Opportunity Tax Credit Questionnaire.

Work Opportunity Tax Credit Program WOTC WOTC is a Federal tax credit incentive that employers may receive for hiring individuals from certain groups who have consistently faced barriers to employment. You may complete and submit IRS 8850 and ETA 9061 forms via our electronic WOTC E-WOTC application processing system. Fill in the lines below and check any boxes that apply.

Current Revision Form 8850 PDF. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. To provide a federal tax credit of up to 9600 to employers who hire these individuals.

Already have an E-WOTC account login here. Is participating in the WOTC program offered by the government. Agency with backup documentation to prove eligibility.

ETA Form 9175 Long-Term Unemployment Recipient Self-Attestation Form IRS Form 8850 PreScreening Notice and Certification Request for the Work Opportunity Tax Credit IRS Form 8850 Instructions Instructions for completing IRS Form 8850 IRS Form 5884 Work Opportunity Tax Credit Use form to report Work Opportunity Tax Credit with tax return. Qualifying Groups For the employer to claim the WOTC for a new hire the employee must be certified as a member of a targeted group by meeting the criteria described in any of the groups listed below.

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit What Is Wotc Adp

Tax Credit Questionnaire Form Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit First Advantage

Work Opportunity Tax Credits Wotc Walton

Work Opportunity Tax Credits Wotc Walton

Completing Your Wotc Questionnaire

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Wotc Questionnaire Fill Online Printable Fillable Blank Pdffiller

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Wotc Forms Cost Management Services Work Opportunity Tax Credits Experts

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Work Opportunity Tax Credit What Is Wotc Adp

Adp Work Opportunity Tax Credit Wotc Avionte Bold